Need help understanding letter

hello12345

Online Community Member Posts: 5 Listener

hi. My mother receives pension credit.

hi. My mother receives pension credit. I got PIP awarded in end of May 2021.

She applied for carer’s allowance as soon as I got the PIP award.

She only applied for carer’s allowance for December 2020 - March 2021 as that’s when she was caring for me.

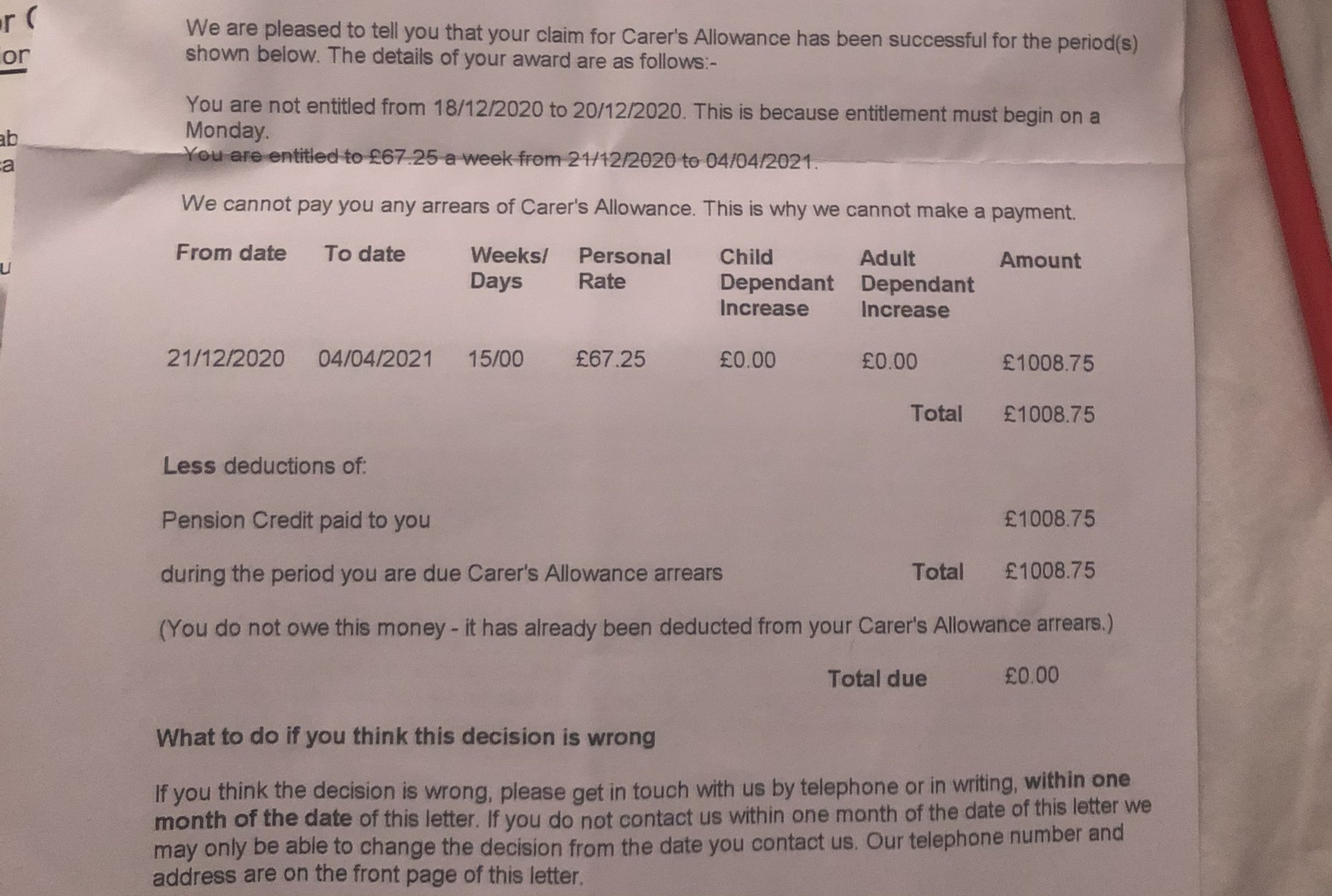

Now she has just received a letter from carer’s allowance and we don’t understand it.

Now she has just received a letter from carer’s allowance and we don’t understand it.

It seems like she was entitled to £1008.75 but they can’t pay her because she is claiming backdated money??

Or is it something she now needs to do through pension credit?

Any help would be greatly appreciated

0

Comments

-

Those that are claiming state pension can claim CA but can't receive it if their state pension is more than the Carers allowance. This is because of over lapping benefits rule. Instead she will have an underlying entitlement to it so could increase any pension credit she receives because they add the carers premium of £37.70 per week.See link for further information. https://www.carersuk.org/help-and-advice/financial-support/help-with-benefits/other-pension-age-benefits

0 -

Thanks poppy. So does that letter mean she will get the £37 from pension credit?0

-

She will need to contact Pension Credit.

0

Categories

- All Categories

- 15.7K Start here and say hello!

- 7.4K Coffee lounge

- 103 Games den

- 1.7K People power

- 149 Announcements and information

- 24.8K Talk about life

- 6K Everyday life

- 480 Current affairs

- 2.5K Families and carers

- 889 Education and skills

- 1.9K Work

- 562 Money and bills

- 3.7K Housing and independent living

- 1.1K Transport and travel

- 632 Relationships

- 1.5K Mental health and wellbeing

- 2.5K Talk about your impairment

- 873 Rare, invisible, and undiagnosed conditions

- 936 Neurological impairments and pain

- 2.2K Cerebral Palsy Network

- 1.2K Autism and neurodiversity

- 40.9K Talk about your benefits

- 6.1K Employment and Support Allowance (ESA)

- 20K PIP, DLA, ADP and AA

- 8.9K Universal Credit (UC)

- 5.9K Benefits and income