Contradictory information regarding enhanced disability premium (single)

Mercaster

Online Community Member Posts: 4 Listener

Hi. I hope someone here who may have experienced the same thing will be able to advise me. In January of this year, I received a council tax reduction notice letter which had listed on it the enhanced disability premium (single) on it. This was £15.90 at the time and this amount was used in calculating my reduction. The problem was I have never received the enhanced disability premium. I queried this with the council at the time and was told that the information they used to calculate my reduction came from the job centre. I was told to pursue it with the job centre as it seemed I was entitled the premium as it had turned up on my decision letter. I didn't feel able to do this at the time. I decided to bite the bullet and try to get more information about why the premium was appearing in my council tax calculation but nowhere else. I first contacted the DWP, who suggested I go into the JobCentre and show them the council tax letter. This I did, but found the lady I spoke to completely unhelpful. She basically contradicted what I had been told by the council tax office, that it was a council tax error, essentially, and nothing to do with the JobCentre. This was a salutary reminder of just how unhelpful the gatekeepers in jobs like this often prove to be. I plan to contact the DWP again to see if I can get a definitive answer to why this is appearing on council tax letters if I'm not entitled to the premium.

I thought I would ask here before I go back to the DWP. So my question is: Am I entitled to the Enhanced Disability Premium or not? The benefits I currently receive are as follows:

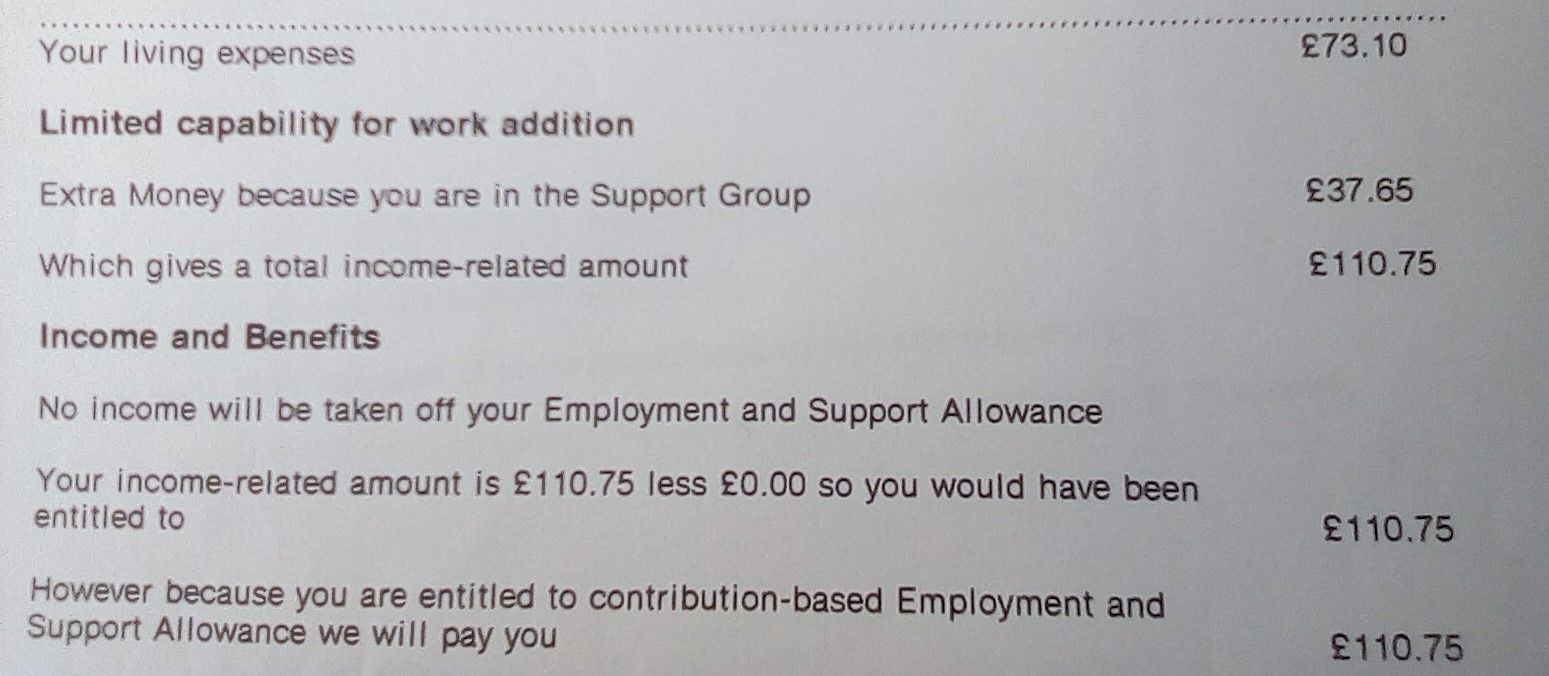

I am in the support group of ESA. My benefit later states that 'because you are entitled to contribution-based ESA we will pay you £110.75.' This figure is made up of £73.10 living expenses and an extra £37.65 because I am in the support group. But the council are using a figure of £125.55 to calculate my council tax reduction, which is where the confusion has arisen. I do not receive PIP or any other add on. I have been in the support group for well over a year, if that makes any difference. I would be grateful for any advice on this matter.

I thought I would ask here before I go back to the DWP. So my question is: Am I entitled to the Enhanced Disability Premium or not? The benefits I currently receive are as follows:

I am in the support group of ESA. My benefit later states that 'because you are entitled to contribution-based ESA we will pay you £110.75.' This figure is made up of £73.10 living expenses and an extra £37.65 because I am in the support group. But the council are using a figure of £125.55 to calculate my council tax reduction, which is where the confusion has arisen. I do not receive PIP or any other add on. I have been in the support group for well over a year, if that makes any difference. I would be grateful for any advice on this matter.

0

Comments

-

Edited to add...

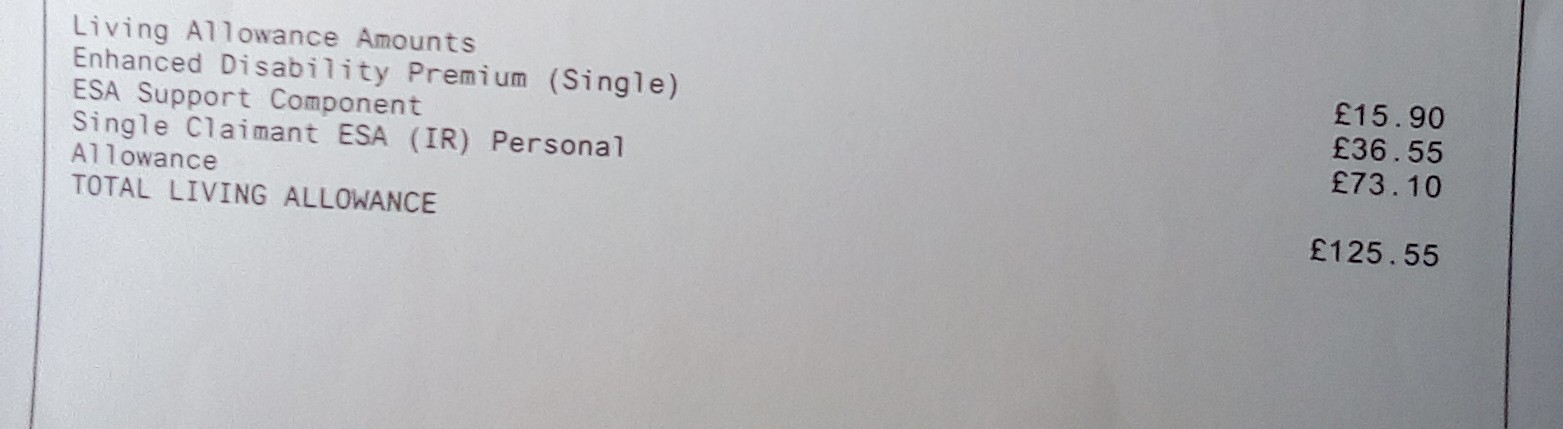

Your award letter that states your in the Support Group...

Mines income related... see if your letter show anything like mine below. If it doesent it's a call to the DWP I'm afraid as someone has cross wires...

0 -

Unless of course mercaster isn't entitled to the Income related top up. If they live with a partner that works or have other household income then it will affect any entitlement to this top up.

0 -

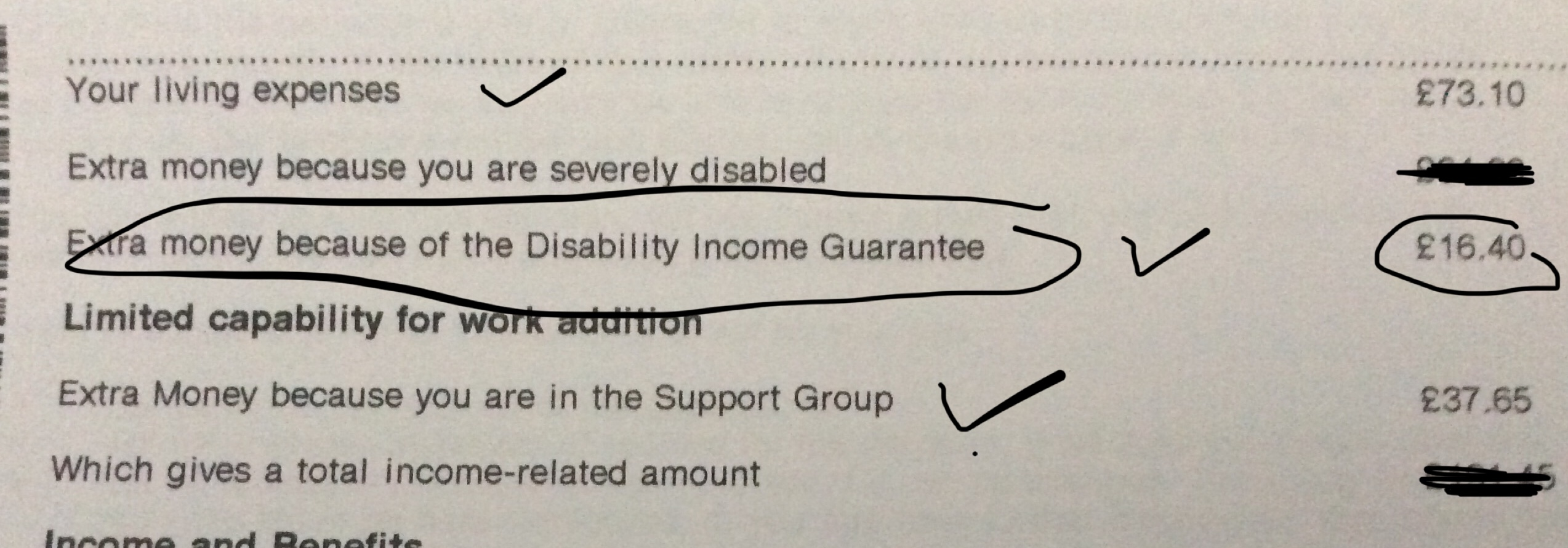

Just to clarify, I have no other household income and live alone. I've posted two images showing the relevant sections of the letters mentioned in my original post. The first shows the calculation made in my last poll tax letter clearly showing the premium I do not get.

The second image shows my most recent benefit letter. Nowhere does it mention the enhanced premium. It's baffling to me why the DWP and the JobCentre between them seem unable to give me a straight answer in this matter.

0

0 -

As you live alone the DWP need to asses you for the Income Related top up and you need to ring them and ask them to send you the ESA3 form, or ask to fill it out over the phone. You can't claim the top up (enhanced disability premium) without first being assessed to see if you're eligible to claim it.

0 -

Also looking at the C Tax photo it clearly states single claiment ESA (ir)

I thought you was on Contribution Based ESA Support Group I believe something here is defo a miss, going by the C Tax letter your on income related ESA?

And your decision letter clearly states your on Contributions Based.

So I think you really need to phone the DWP0 -

Thanks for the feedback. I'll let you know how it goes.0

Categories

- All Categories

- 15.7K Start here and say hello!

- 7.4K Coffee lounge

- 103 Games den

- 1.7K People power

- 149 Announcements and information

- 24.7K Talk about life

- 6K Everyday life

- 468 Current affairs

- 2.5K Families and carers

- 888 Education and skills

- 1.9K Work

- 555 Money and bills

- 3.7K Housing and independent living

- 1.1K Transport and travel

- 630 Relationships

- 1.5K Mental health and wellbeing

- 2.5K Talk about your impairment

- 873 Rare, invisible, and undiagnosed conditions

- 936 Neurological impairments and pain

- 2.2K Cerebral Palsy Network

- 1.2K Autism and neurodiversity

- 40.8K Talk about your benefits

- 6.1K Employment and Support Allowance (ESA)

- 20K PIP, DLA, ADP and AA

- 8.9K Universal Credit (UC)

- 5.9K Benefits and income