To those migrating to UC be warned about council tax support

Just thought I'd give a head up to those moving to UC that your council tax may be reduced on UC mum moved from ESA to UC and once the council knows about the move as UC tells them we got am email to tell us that now she's moved to UC her council tax support is being reduced from 100% to 80% and will get a new bill soon.

No one told us about this so we weren't aware so thought I'd let others know so you know before hand.

Comments

-

Hello @sunflower2. Thank you for posting this.

It is definitely important for people to be aware of. Most councils no longer do 100% council tax support, and many people are finding themselves responsible for more than before. I would also add it is worth going through the council tax credit award letter with a fine tooth comb as it is not uncommon for them to miscalculate.

3 -

it’s been ‘no longer 100%’ (unless pensioner) for a number of years.

court cases were escalating (non payment) for those that were on 0% contribution moved to 15% or 20% or so householder contribution.

apparently some councils are asking for 50% or even 75% householder contribution to help balance their books.

as UC is not a passported benefit councils may ask for more contributions to.1 -

Mine has always been 100% and still is. I never have to pay council tax as I get a full award and not a pensioner.

1 -

I am not sure if it is regional, but it is certainly true in my area that migration to UC is impacting whether people pay CT/how much CT they pay.

It is worth checking in with your CT department and finding out what their regulations currently are.0 -

My local council offers a 100% CTR award, it's a 90% standard discount and they've chosen (from discretionary funds) to bump that up to 100% for certain people of working age.

0 -

Angus Council doesn't charge me Council Tax, but I pay about £30pcm "Water and Sewerage". We don't have water meters in Scotland.

0 -

Fortunate for you.

Since 2013 CTR localisation changed Council Tax contributions for the majority. (I think worse if your council had more pensioners, so the scheme was less generous for Working Age Claimants)

https://ifs.org.uk/news/cuts-support-mean-13-million-more-low-income-households-get-council-tax-bill-quarter-extra-tax

0 -

The user and all related content has been deleted.0

-

Our income hasn't changed except for moving to UC and she has no savings or pensions.

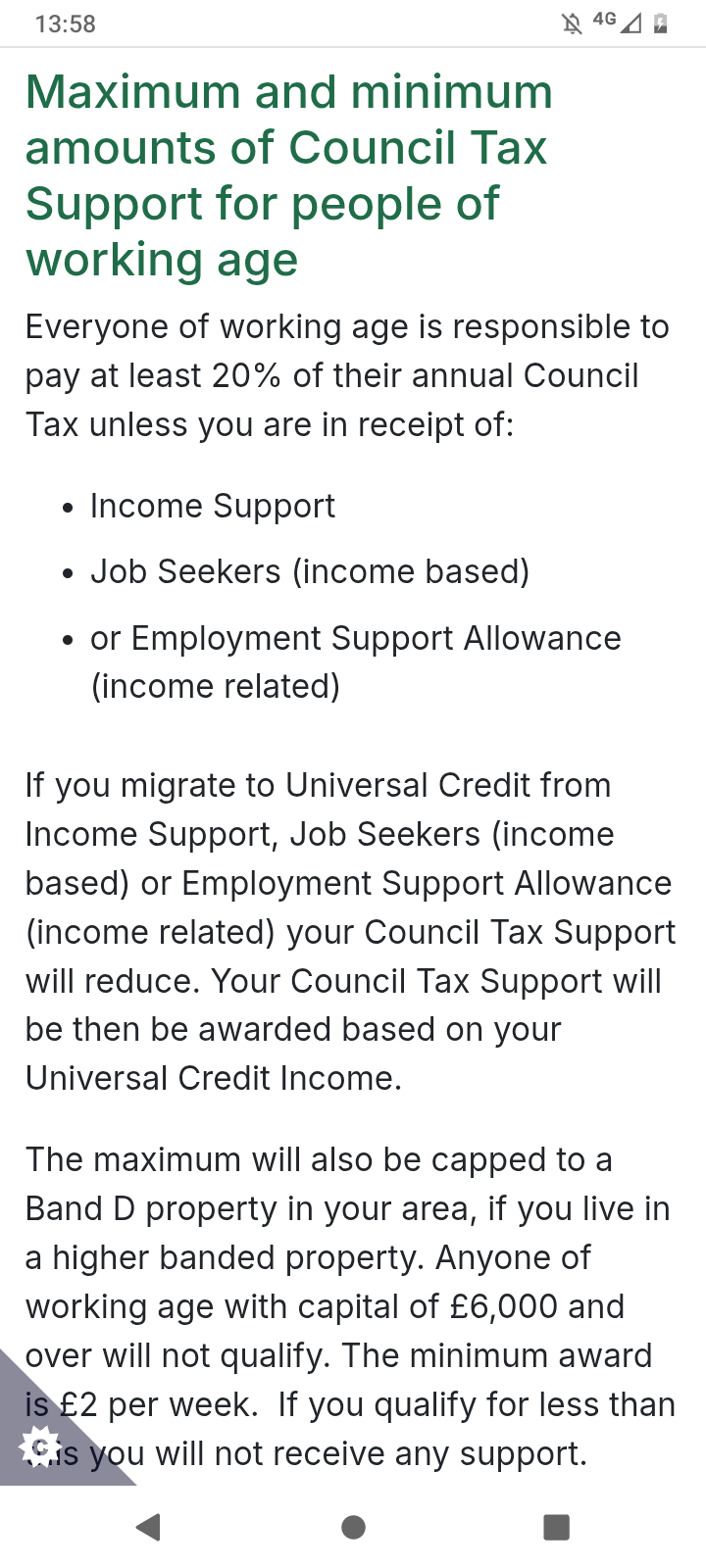

Even on our councils website it says that if you migrate to UC you will have your council tax support reduced.

1 -

Council tax is decided locally by each local council, the rules for that are not the same nationally, so it's impossible to compare across the country.

Also, many councils treat UC income differently to the way they treated legacy benefits. That is why some people have to pay more council tax on UC than they did on ESA etc. In my area, it is not calculated differently, I still got exactly the same discount after my migration.

1 -

The user and all related content has been deleted.0

-

The user and all related content has been deleted.0

-

There are many threads and posts on here showing how council tax reduction is now calculated differently by various councils across the country. Many now include things like LCWRA and Housing Element as income, whereas previously they did not. This is not simply about the eligibility, it's also about the level of reduction that is applied, based on the level of income. Many people do have to pay more council tax after migrating to UC, that's been shown on here so many times. I don't know how you can possibly dispute that.

0 -

The user and all related content has been deleted.0

-

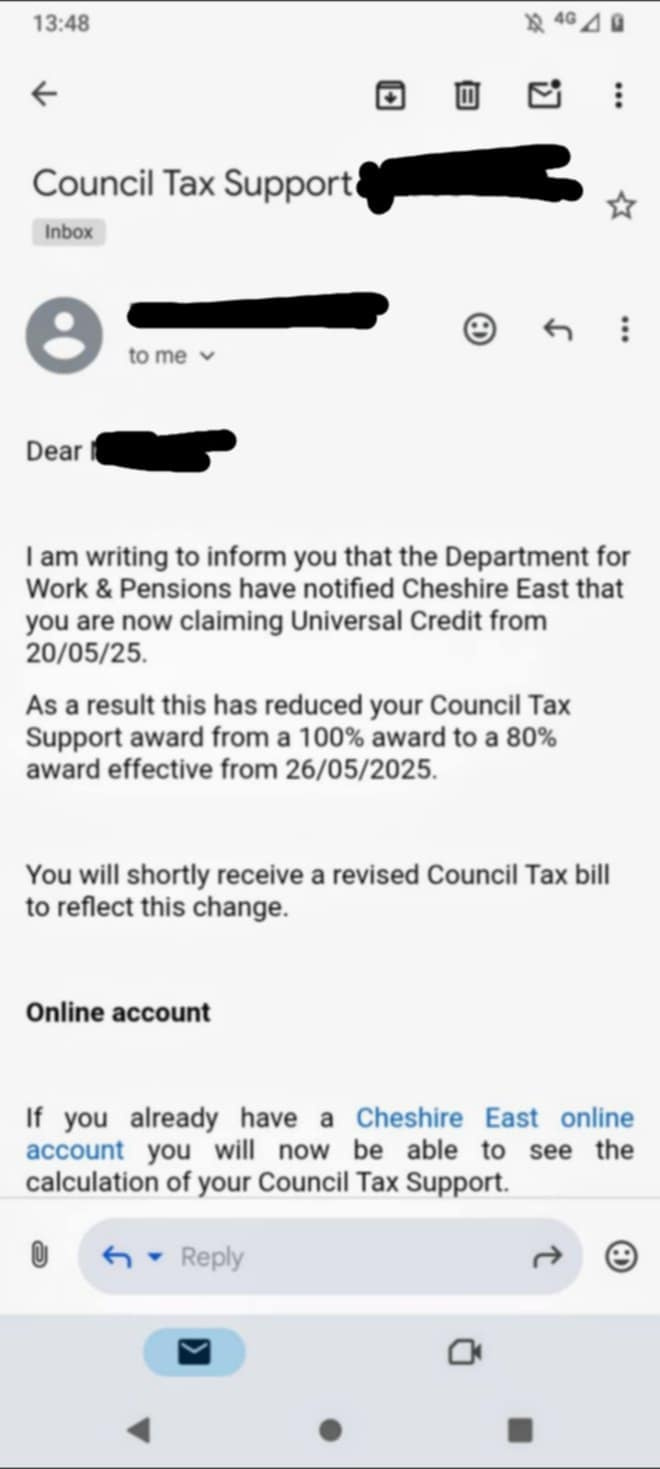

I doubt very much contacting them will change anything they clearly count UC as income or at least treat it differently to legacy benefits here's a screenshot of the email we received, I've crossed out personal info.

2 -

Try Cheshire east then because they do this is a screenshot from there own website were they state when you migrate to UC it will be reduced.

My mum has no savings no pensions. All she gets now is UC and she still hasn't got the right awarded yet she should get standard,housing and LCWRA but that's not been added yet.

She was only receiving income based ESA and was in the support group before she migrated.

She only gets UC and yet our CT support has been reduced.

0 -

The user and all related content has been deleted.0

-

Council Tax Discounts are a national scheme.

Council Tax Reduction is decided on at a local level and each local authority has different rules for eligibility.

They are free each financial year to change that eligibility - I know through here and another forum of three local authorities who for the first time this year, stopped excluding PIP and started including it in it's financial calculations as to how much CTR a person was eligible for.

Local authorities do treat UC differently to legacy benefits. Legacy benefits automatically entitled a person to the maximum available CTR (whether that was 100% or not). UC doesn't give the same entitlement.

3 -

The user and all related content has been deleted.0

-

I have been migrated from ESA Support to UC and got my first payment today - which has been all wrong and such a stress.

I am dreading council tax. My council never gave 100% reduction for ESA. I still had to pay £42 a month - even though on benefits and a single person. So, knowing this will go up is making me quite scared.

Do they count the LCWRA element and the transitional protection as income?

0

Categories

- All Categories

- 15.7K Start here and say hello!

- 7.4K Coffee lounge

- 103 Games den

- 1.7K People power

- 149 Announcements and information

- 24.7K Talk about life

- 6K Everyday life

- 469 Current affairs

- 2.5K Families and carers

- 888 Education and skills

- 1.9K Work

- 555 Money and bills

- 3.7K Housing and independent living

- 1.1K Transport and travel

- 630 Relationships

- 1.5K Mental health and wellbeing

- 2.5K Talk about your impairment

- 873 Rare, invisible, and undiagnosed conditions

- 935 Neurological impairments and pain

- 2.2K Cerebral Palsy Network

- 1.2K Autism and neurodiversity

- 40.8K Talk about your benefits

- 6.1K Employment and Support Allowance (ESA)

- 20K PIP, DLA, ADP and AA

- 8.9K Universal Credit (UC)

- 5.9K Benefits and income