National Insurance credits

Hello, I just wanted to clarify something.

I have a client who is age 64 and who's paid 44 consecutive years of NI credits through full time employment. [He therefore more than meets the 35 years requirement for his full state pension.]

At age 60, he was medically retired on grounds of ill health. He hasn't worked since. He claimed ESA at age 62 but was turned down as he hadn't paid NI in the previous 2 tax years. The claim wasn't converted into a credits-only claim (client didnt know to ask for this).

He's now been told by HMRC he still owes about 2 years worth of NI conts before he can get the full state pension.

Is this correct ? He has paid 44 years of full NI conts through full time employment.

If it is correct then I assume this is because he didn't claim NI credits when he stopped work, on the basis of ill health. Despite working for 44 years.

I'd be grateful if someone could clarify this for me.

[I've asked client to put in a new claim for ESA , so I can help him get it converted to credits only claim, and if necessary I can perhaps write to ESA and ask them to backdate credits. Client can get backdated fit notes.]

Comments

-

Don't be too sure about 44 years paying for a full state pension by way of credits..

Your client needs to get a State Pension Forecast … in writing

I have over 45 years credits (and still need another 3 to get a FULL sp)

This is due to the type of credits (I was a civil servant and was contracted out for over 30 years) - this reduces the efficacy of the credits……

1 -

Thanks Wibbles

So just to clarify, client showed me his NI record and qualifying years (which he requested from HMRC and they provided) and it clearly states "Payment Not Needed" against all of the 44 consecutive years listed on the record.

The problem seems more to do with the fact he hasn't been working or claiming anything from age 60 -64.

0 -

Even though your client has 44 years of NI contributions, gaps after 2016 can still affect entitlement to the full new State Pension. Because he didn’t claim ESA or receive NI credits after retiring on health grounds, those years are currently treated as missing.

Submitting a new ESA credits only claim, supported by fit notes, is the best route to recovering missing NI credits. Backdating isn’t guaranteed, but it’s worth requesting especially given the client’s long work history and medical retirement. If successful, this could reduce or remove the need to pay voluntary contributions.

It’s also worth checking the client’s full NI record and requesting a State Pension forecast to confirm exactly which years are short and what impact that has on entitlement.

3 -

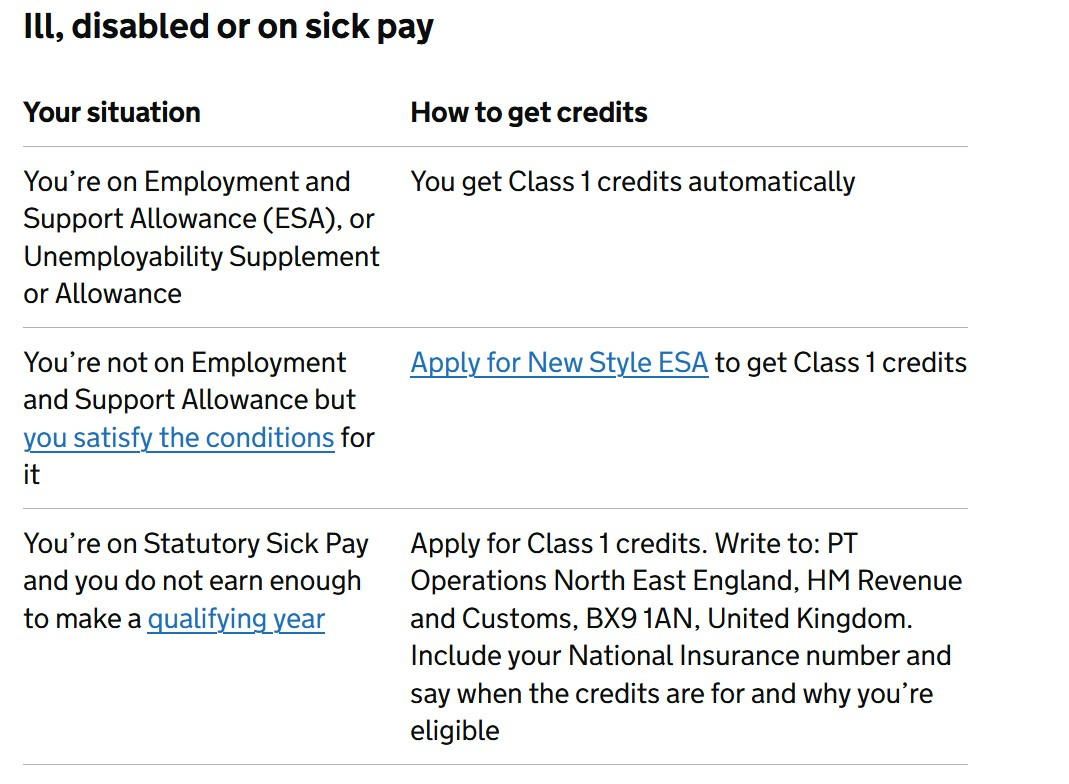

Do what I do and claim the missing years by the second level below - ie) SATISFYING THE CONDITIONS FOR BUT NOT ACTUALLY RECEIVING ESA !

4 -

MW123 thankyou that is very helpful.

0 -

Hello @Soapkate

I am concerned about something you said.

'The claim wasn't converted into a credits-only claim (client didnt know to ask for this).'

It is usually done automatically. There is no 'conversion' process. ESA award 2 things: payment and credits through the ESA claim.

So you shouldn't need to separately ask for a credits only claim to be opened. This is because the only way to get credits only is to apply for ESA in the same way.

ESA decision letter should say something like 'We may still continue to award you national insurance credits'. At this point your client (I presume you are working for some organisation e.g. Age UK etc…?) would have carried on with ESA in the usual way with fit notes etc… and gone on to have a WCA and decision and credits would have continued.

Best to call ESA and see what's happened. Sometimes ESA credits only claims get forgotten about by ESA and can continue awarding credits for years as they are not a priority as no payment is being made.

Equally can call or write to HMRC to get a copy of NI record.

1 -

0

-

Hi just wanted to share an update, thanks for all the helpful comments.

I rang ESA and it seems a credits claim was never properly processed for my client when he claimed. It's not clear why, and helpline adviser could not explain.

So we put in another claim and this time it was properly processed and he's been awarded credits. He has two years left until state pension age, he will by then have covered the gap , to entitled him to full state pension. Good outcome.

Thanks all.

2 -

Good to hear it's been sorted @Soapkate, thank you for updating us

0

Categories

- All Categories

- 15.8K Start here and say hello!

- 7.5K Coffee lounge

- 105 Games den

- 1.8K People power

- 158 Announcements and information

- 25.2K Talk about life

- 6.2K Everyday life

- 508 Current affairs

- 2.5K Families and carers

- 873 Education and skills

- 2K Work

- 579 Money and bills

- 3.7K Housing and independent living

- 1.1K Transport and travel

- 642 Relationships

- 1.6K Mental health and wellbeing

- 2.5K Talk about your impairment

- 878 Rare, invisible, & undiagnosed conditions

- 939 Neurological impairments and pain

- 2.2K Cerebral Palsy Network

- 1.2K Autism and neurodiversity

- 40.8K Talk about your benefits

- 6.1K Employment & Support Allowance (ESA)

- 20.3K PIP, DLA, ADP & AA

- 9.1K Universal Credit (UC)

- 5.3K Benefits and income