Reporting capital

Hello everyone

We are currently in the middle of a review and we've never updated our savings, obviously this was a big mistake, my question now is do we report our current savings? I'm confused though because I receive pip, my daughter receives dla, she had a back payment last march which was nearly 2k, we've also had col payments of 900 pounds, can we subtract this from the figure we declare? This is my first post here so please bare with me 😂 any help would be gratefully received though, thank you

Comments

-

Hi,

If you have an online journal you can report the savings through there under the 'make a change' section.

If you and your daughter share a bank account and are both on UC then that is going to make declaring savings more difficult. I don't really have any advice for working out how much each of you has if that is the case.

For the DLA backpay, there is now a specific section for that when declaring savings online. So you put your full bank account total on the first page. Then put the backpay on the 'disregards' page, in the box for benefit backpay. The disregard for that will end 12 months after it was paid, so March 2026 in this case.

COL payments are more difficult. Legally they are deductible, but there is no section for this on the online form. UC staff generally tell people to declare the full account amount, and then send them a journal message afterwards for the UC staff to disregard the COL payment manually. In my experience, they don't actually do that. In fact I never had confirmation that they even read the message, so I have been deducting mine before declaring savings ever since, but that isn't really the correct way to do it.

If you have well under £6000 total then it doesn't really matter about the COL payments, because you won't get any savings deduction anyway. It is only for people over £6000 who will lose money by not deducting correctly.

1 -

Thank you for that

Do you know if pip and dla are treated the same in regards to when the become capital? So should I subtract December's payments of these benefits when declaring capital on 31st that's when our AP ends, I find all this so confusing, obviously anxious about the current review as well. Thank you

1 -

This is where it gets more complicated unfortunately. UC reviewers don't appear to be deducting any benefit income.

Technically you should be able to deduct unspent benefit income during the current payment period. (Not the total payment, as you will have spent some since receiving it). However, it's a very complicated calculation trying to work out how much you've already spent from it, especially with multiple payment dates for different benefits each month.

Based on the most recent information we have, I would have to recommend not deducting any benefit income from your savings declaration, because that is the way the UC review staff seem to be doing it.

1 -

Hi

I think I might have made an error when I declared our capital, Initially I reported the amount in our bank + help to save, and then subtracted the last backpay we received last march, but then I realised I didn't subtract the col payments or help to save bonus, so I declared it again and it was obviously lower, but now I'm thinking I should have subtracted payments received in December? I've now been called to the job centre to give bank statements, which has been tricky trying to organise as they want paper statements, they also are unaware of an account in our daughter's name, which was originally used for birthday & Christmas money and later DLA payments, obviously this is gunna flag up as it shows transfers from our current account to daughter's account, I suffer with really bad anxiety and all this is really worrying me now.

0 -

Hi,

I think it's just best to wait for the UC staff to sort it out after you've provided the bank statements now. Try not to worry about it in the meantime.

As mentioned above, they don't seem to be deducting unspent benefit income, so I wouldn't recommend doing that yourself either at this time. (That may change in future if we get new information).

They may also tell you a different way to deduct the COL payments.

I don't have any experience with Help To Save I'm afraid. Not sure whether the bonus is disregarded from savings, or whether there's a specific section to put that when declaring online.

1 -

I think you're right in saying wait till they decide Tuesday, it's just I'm a little confused because in a different post you mention income not becoming capital untill the assessment period of the one it's received in, that's why I thought should December's payments not count yet? And if that's the case then I should have reported capital for November? It's all very confusing, I'm worried they are going to say we have more capital then we actually do.

0 -

It is confusing unfortunately.

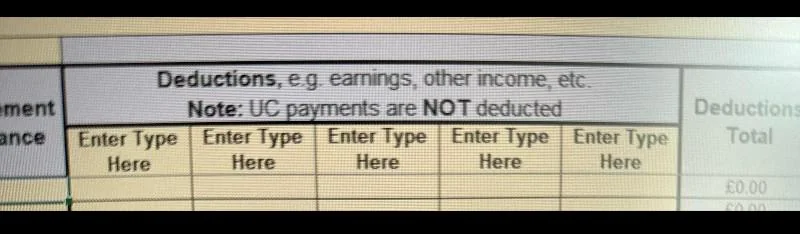

Unspent income shouldn't count as savings legally. But it's a very complicated calculation. Far more complicated than just taking away the entire payment. So the UC review team do not appear to be deducting any UC income at all, spent or unspent. (We've recently seen proof of their computer screens showing this).

1 -

1

-

It's confusing because whilst our claim is being reviewed, I had to attend local job centre for a further evidence interview this week to give bank statements for last 3 month's, I don't even know if one department is talking to the other, but if they add all are capital we would be very close to max threshold, but if they disregard Decembers payments & back pay it will be much lower, I'm really stressed & anxious over all of it, I suffer with complex mental & physical health issues, We've not had January's statement tet either, which is always done on the 1st

1 -

As long as you've told them the backpay was received less than 12 months ago then they will deduct that. There shouldn't be any debate about that one.

Also if you've told them about the COL payments, they should deduct those as well, although they might need to be reminded about it, it's not done automatically.

I did ask earlier whether you had over £6000, as it really doesn't matter if not. But if you've got nearly £16,000 then it does matter and unfortunately you will have to make sure they're getting everything right.

I'm really not expecting them to deduct the latest payments, but it sounds like you're not relying on that anyway. As long as the backpay and COLs are deducted that should be enough in this case.

0 -

So I went to the JC for this further evidence interview, they've taken photocopies of everything to send to a decision maker, and said we won't receive payment which is due tomorrow, until that's been verified, is that normal practice?

1 -

Thank you for the update.

Yes that is normal practice when the capital review has been triggered by a change in savings. Payments are suspended until the capital can be verified.

Hopefully it won't take them too long to make a decision now.

0 -

So they've come back with a figure for our capital and they've only disregarded the backpay we received last march, because I'm in the lwrca group and we receive element's, for housing, carers & disabled child, I'm worried about breaching the upper capital limit eventually, it's a crazy system, because I know I'll loose lwrca if that happens, and then once we drop back into entitlement we can claim again? But this could happen repeatedly, I'm sure everyone knows the hurdles you have to jump through to be awarded lwrca and obviously that will change with reforms in april, we've tried to move as well but private landlords are in such demand they can literally pick & choose there tenant's, so it's like a vicious cycle, I can't tell UC sorry you're giving us to much money, please have some back, I have read about paying into private pensions? Can you do this on UC as I don't have anything saved for my retirement, but in truth that's because I don't think I will live that long for it to be needed or world event's will destroy the financial system at some point.

1 -

Hi,

Good to hear the review team have confirmed your capital is under the limit now.

You could push them to deduct the Cost of Living payments as well, assuming your accounts never dropped below the COL amounts since receiving those.

I am in a very similar situation myself, as are a few other members on here. However it's very difficult to discuss as it often ends up with some getting upset that we get more than we can use. (Not that I'd wish my existence on anyone, I'd rather have the ability than the money!) I'm also in unsuitable accommodation and would spend more if I could move to a more suitable property but it's just not possible with the private rental market as it is now.

You're absolutely right that if you lose UC then you'll lose LCWRA and have to start a brand new claim when the savings drop below the threshold again. That will almost certainly be after April now, meaning that you're likely to end up with a much lower UC income when the changes to LCWRA amounts come in. There is a potential workaround for this, although I haven't seen anyone do it in the real world yet.

The workaround is applying for New Style ESA. You will be refused payments if you haven't worked within the last 2 years, however you may be given the class 1 NI credits instead. This is known as a 'credits-only' claim. The important part about this is that it's not means tested, so it keeps the LCWRA status open even if you lose UC. In theory this should mean that you get automatic LCWRA when starting a new UC claim, but as I say, this is only a theory at the moment, I haven't seen anyone do it so far. (Also worth noting NS ESA can't be claimed as well as Carers Allowance, I'm unsure whether you're getting Carers Allowance or just Carers Element).

Regarding private pensions, yes you absolutely can pay into one while on UC, as long as it's coming out of your UC income each month. I wouldn't recommend moving savings into one as that can be seen as Deprivation of Capital. There is a limit on pension contributions each year for tax reasons. At the moment that limit is £2880 per year for someone without earnings. That works out as a maximum of £240 a month, though of course you can choose a lower amount without any problems.

Aside from that, having a child may mean you can spend a bit more money on things to improve their quality of life as well as your own. I don't have children myself.

0 -

You mentioned about private pensions coming out of UC income, does that mean I'll need to tell UC about it, and that the £240pm just an example would come directly off UC payment each month?

0 -

No, you don't need to tell UC about it. And you can't have it paid directly from UC either.

When you get paid UC, that payment counts as income for the first month.

After that it counts as savings instead.

So I would recommend paying into the private pension directly from the bank account that UC gets paid into, and doing it shortly after getting a UC payment. That way it is definitely coming out of income, not savings. Hopefully that makes sense.

0

Categories

- All Categories

- 15.8K Start here and say hello!

- 7.5K Coffee lounge

- 105 Games den

- 1.8K People power

- 159 Announcements and information

- 25.2K Talk about life

- 6.2K Everyday life

- 508 Current affairs

- 2.5K Families and carers

- 873 Education and skills

- 2K Work

- 579 Money and bills

- 3.7K Housing and independent living

- 1.1K Transport and travel

- 642 Relationships

- 1.6K Mental health and wellbeing

- 2.5K Talk about your impairment

- 878 Rare, invisible, & undiagnosed conditions

- 939 Neurological impairments and pain

- 2.2K Cerebral Palsy Network

- 1.2K Autism and neurodiversity

- 40.8K Talk about your benefits

- 6.1K Employment & Support Allowance (ESA)

- 20.3K PIP, DLA, ADP & AA

- 9.1K Universal Credit (UC)

- 5.3K Benefits and income