Overwhelmed with employing a PA.

Hi everyone,

I am so overwhelmed with becoming an employer with my direct payments.

I feel I have a very unique set of circumstances and I desperately need help in fully understanding things.

I have recently been awarded direct payments, I feel my situation is unique, because my PA is also my friend, I take up a lot of my friends time because I am autistic and agoraphobic, and there are a lot of things I am only able to do with my friends assistance, without my friend I an housebound.

On my care plan t's 10 hours a week, but it's not always the same 10 hours, so how do we write that into a contract?

For example next week, I have an appointment on Tuesday, and an appointment on Wednesday, on those days we will also do other things in my care plan, like go for walks and go shopping.

But as my PA is also my friend, I might also go to her house on, for example, Thursday evening, or Friday morning, we might even do similar things that are in my care plan, because I enjoy doing them, but for those moments we will be doing them as friends, not PA/employer, this is all confusing me so much on the legal side of things and insurance.

Sometimes we are going to start the day off in the role of pa/client, but then it becomes us as friends, for example:

She may pick me up at 9:30am, take me to an appointment, make a phone call for me, take me shopping and then we will go for a walk, that might take up 5 hours of her time, but then her care role will end and I'll go with her to pick her children up from school, and then go back to hers for the evening for tea, that's as friends, not PA and client.

Also I have read that my friend needs business car insurance, but sometimes I'm going to be in her car her friend, not her client, so how do we work this out?

I also have questions about the amount, I haven't had my financial assessment yet (that happens next week), the estimated budget they've given me is £146.97 per week, but out of that they need to fund 10 hours for my friend/PA, plus they'll also need to factor in employers insurance, NI and tax, plus holiday pay? Plus money for a payroll service?

I have asked on Facebook, but I still have so many questions that I am hoping somebody here can help me to understand.

I also have questions about the disability related expenditure, should I perhaps open a different thread for that?

Comments

-

Hi @BiscuitBiscuit I see why this is somewhat complicated for you both. I think, perhaps the best way to look at it in this situation is maybe take an overarching view of a longer period of time, say a month, and come to an agreed value based on the average work/friend split. Because it sounds like the work/friend balance can fluctuate, by looking at a larger period and agreeing an average value it covers those times when the balance might be higher or lower on individual days. I hope I've explained that ok.

It also might be an idea to have a chat with Carers UK. I've added a link to their website, a page dedicated to direct payments which has some helpful information. However, if you were to give them a call, they might offer you some additional advice on setting this up, especially relating to your NI, tax, and holiday questions - Direct payments | Carers UK

With regards to the disability related expenditure, it might be a good idea to create a new thread as it'll help you to get more views and advice. ☺️

1 -

Firstly, I would like to say welcome to the community.

In answer to your questions above. You can absolutely have a flexible contract that says something like “10 hours a week, arranged based on weekly needs by mutual agreement.” That way, you don’t need to set exact days or times in advance. It gives you both some structure without boxing you in.

Just keep a basic record each week of what hours are worked as paid support, like time spent at appointments or helping with tasks. This makes things easier for payroll and shows when your PA was officially working.

It’s also fine to do similar things during and outside of PA time. What matters is the purpose. If it’s support from your care plan, that’s work time. If it’s just spending time as friends, that’s personal. You don’t need to over complicate it, just be clear about when your friend is switching roles.

Regarding car insurance your PA does need business use cover for driving you in her PA role during work hours. Normal insurance is fine when she’s giving you lifts outside those hours, as a friend.

Your budget isn’t just for wages, it should fully cover holiday pay, National Insurance, payroll, and employer’s insurance too. You shouldn't be expected to pay out of pocket, that's what the financial assessment is for. The weekly budget of £146.97 is intended to cover everything, 10 hours of your friend’s pay plus all associated employment costs.

When you attend your assessment, make sure you mention your Disability Related Expenditure, it should be a key part of the financial assessment. DRE includes the additional, unavoidable costs you face because of your disability, such as higher energy bills, transport to appointments, specialist food, or extra laundry.

These aren’t lifestyle choices, they are essentials for maintaining your independence and wellbeing. List everything clearly, and explain why each item is necessary. Under the Care Act, the local authority has a duty to consider these costs, so make sure you have these clearly listed.

When you have your financial assessment, make sure you explain all of these costs, so they include enough money in your budget. If you think the amount won’t stretch far enough, you can ask for a review.

All the best with your assessment.

1 -

Hello 👋 👋,

Thank you both so much for your responses, the information you've both given has already eased my mind a little bit, there seems to be so much to understand with this process.

My financial assessment is tomorrow.

0 -

I find it very reassuring that we can have a simple employment contract, we do obviously spend time together as friends, so I was worrying quite a lot about how that's worked out with insurance, but now I think that perhaps I was overthinking that.

Am I right in thinking that my friend will need to get business insurance for her car?

0 -

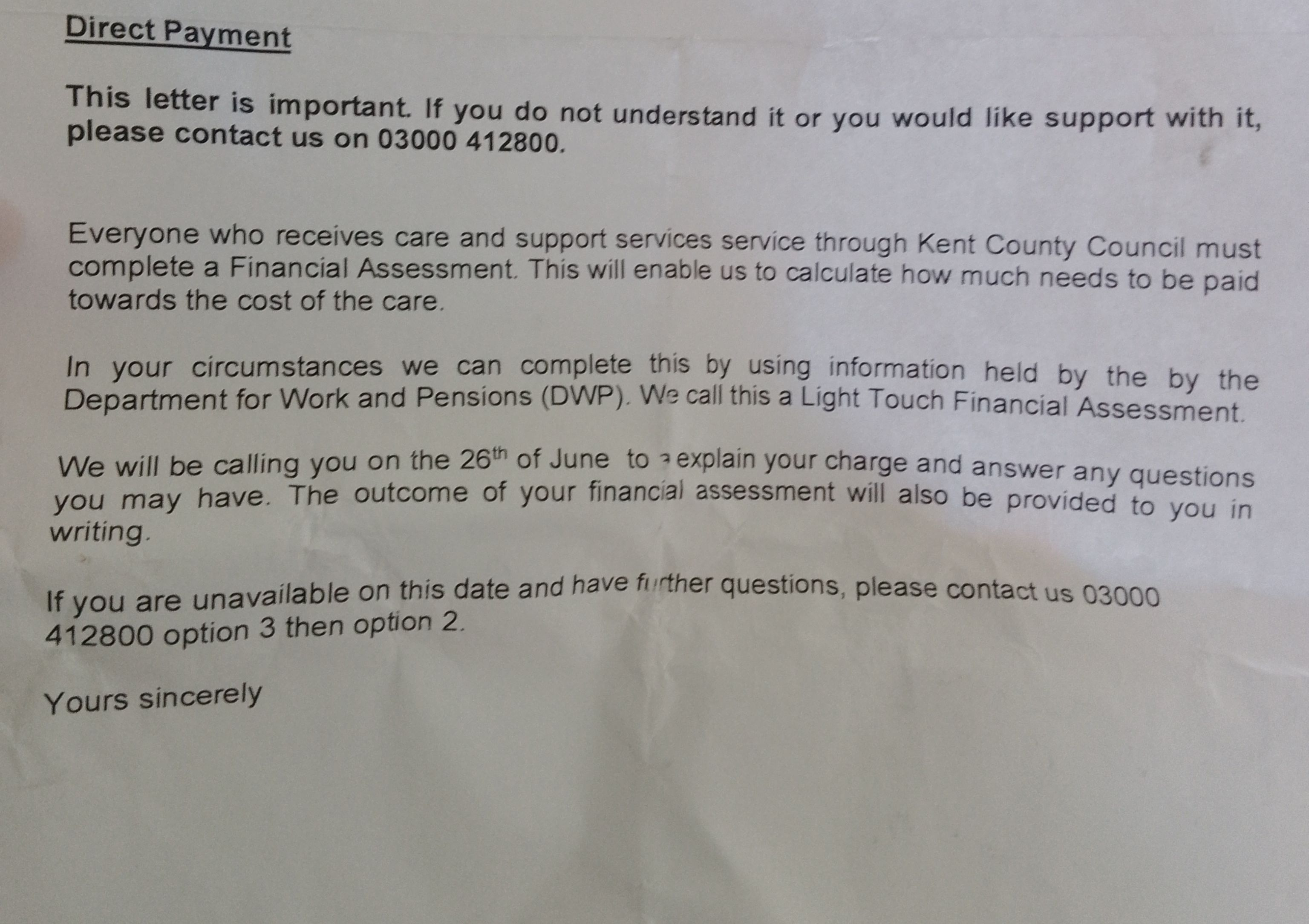

This is the letter I have (original assessment date was June 26th but we moved it to tomorrow) it says it's a light-touch financial assessment, so it's a bit confusing.

0 -

The letter you received about your financial assessment for direct payments appears to follow a standard template. That said, the mention of a “light touch” assessment may understandably cause some confusion.

Typically, a light touch assessment is intended to be less formal and less intrusive than a full financial review. What also stands out is the lack of practical information. The letter doesn’t explain what the assessment will actually involve, what kinds of questions you’ll be asked, or which documents you’re expected to bring. It doesn’t say how long the meeting will take, who will be conducting it, or how the information will be used to make decisions about your support.

It feels a bit like they are saying, “Just turn up and we’ll figure it out!” which isn’t exactly comforting. I’d suggest taking along anything you feel is relevant to your financial situation, along with any supporting medical documentation. It’s always better to be overprepared when the guidance is this vague. Hope it goes well tomorrow, even with limited information, I am sure you will handle it just fine.

0

Categories

- All Categories

- 15.7K Start here and say hello!

- 7.4K Coffee lounge

- 103 Games den

- 1.7K People power

- 149 Announcements and information

- 24.7K Talk about life

- 6K Everyday life

- 468 Current affairs

- 2.5K Families and carers

- 888 Education and skills

- 1.9K Work

- 555 Money and bills

- 3.7K Housing and independent living

- 1.1K Transport and travel

- 630 Relationships

- 1.5K Mental health and wellbeing

- 2.5K Talk about your impairment

- 873 Rare, invisible, and undiagnosed conditions

- 936 Neurological impairments and pain

- 2.2K Cerebral Palsy Network

- 1.2K Autism and neurodiversity

- 40.8K Talk about your benefits

- 6.1K Employment and Support Allowance (ESA)

- 20K PIP, DLA, ADP and AA

- 8.9K Universal Credit (UC)

- 5.9K Benefits and income