The DWP capital thresholds should be £10.5k and £27k

Comments

-

Haha it would appear so

2 -

This is not about people having more money though, it's simply making sure they don't lose it.

You can have more money in your pocket next year, but not be wealthier. That's just how inflation works.0 -

I don't mean to attack pensioners here as you could argue it's right that older people have higher capital thresholds as you're more likely to have savings as you get older but as indicated, we already do have the situation you describe as pensioners are much more likely to own their own home.

The lower threshold for pensioners is £10k and the tariff income is applied on every £500 above that, unlike those of working age where it's £250. The upper limit of £16k also doesn't apply to those getting Pension Credit and Housing Benefit.

They also are one of the only groups that are eligible to receive full housing benefit.1 -

Well this is effectively what we had in 2006 and I don't remember the media going crazy over it. How times have changed huh? I guess it reflects how messed up our economy currently is.

0 -

Maybe that should be done for working people too, so they don't get robbed for more tax paying for what you suggest? Inflation has not altered the working people's Personal Tax Free Allowance since before the lockdown and won't up to 2030.

1 -

No-one is talking about capital thresholds for benefits though, whereas there is currently a lot of political pressure on the chancellor over the personal allowance.

Ultimately, there's a general disdain in society for people on benefits, the media paint it as everyone on benefits being scroungers, or down the pub all day, living a lifestyle they wouldn't be able to afford in work. Despite many people claiming benefits because they're sick or disabled.

It's just how it is and it can affect a lot things, like where you can rent, whether you can get a mortgage etc, etc. It can also make mentally ill people very paranoid as they think everyone is trying to shop them for even just going for a short walk.2 -

I.

I'm not pension age but own my home. I have some savings from working for over 40 years before I had to claim benefits. My house is about 140 years old and the roof is coming to an end having been patched for years. I cannot save enough before my benefits are stopped.. catch 22 situation. I see others ( no ill will to anyone ) getting rent paid in full in some cases, but I am not allowed to save enough for repairs. Surely there should be some leeway?

2 -

Technically you could take out a personal loan and use that to get the work done. But you'd obviously need to speak to the DWP before you went down that route as obviously if thousands of pounds hit your account it could cause a lot of problems.

0 -

The system is designed so that most people do not get their rent paid. Well, paid fully that is as housing benefit, LHA, UC housing element or whatever does not cover average rent. It's set at 30% of local rent.

Also the amounts have been frozen since 2020, although they will be unfrozen next year I believe. Since 2020 rent has skyrocketed too, especially just after covid.

For example a room in a HMO where I live (outside of London) is about £700/month, although that does include bills.0 -

It is obvious there will be a lot of pressure over the pathetic Personal Tax Free Allowance of £12,570 which has been frozen up to 2030 too. The allowances for earnings have not changed much either with more workers moving into the 40% tax bracket. I worked for 40 years I know their grievances. I genuinely think this allowance stops people look for work actually.

It is not a disdain on people on benefits, it's the colossal amount it is costing which has increased markedly in just a few years. Tax payers want the money going elsewhere really like the NHS, disability support in the community etc. Take no notice of newpapers, the majority of people don't think you are all down the pub etc.

Being just how it is unfortunately is not acceptable anymore by working tax payers I am sorry to say.

0 -

My rent on a house is less than £90 per week. So glad I don't live near that London!

1 -

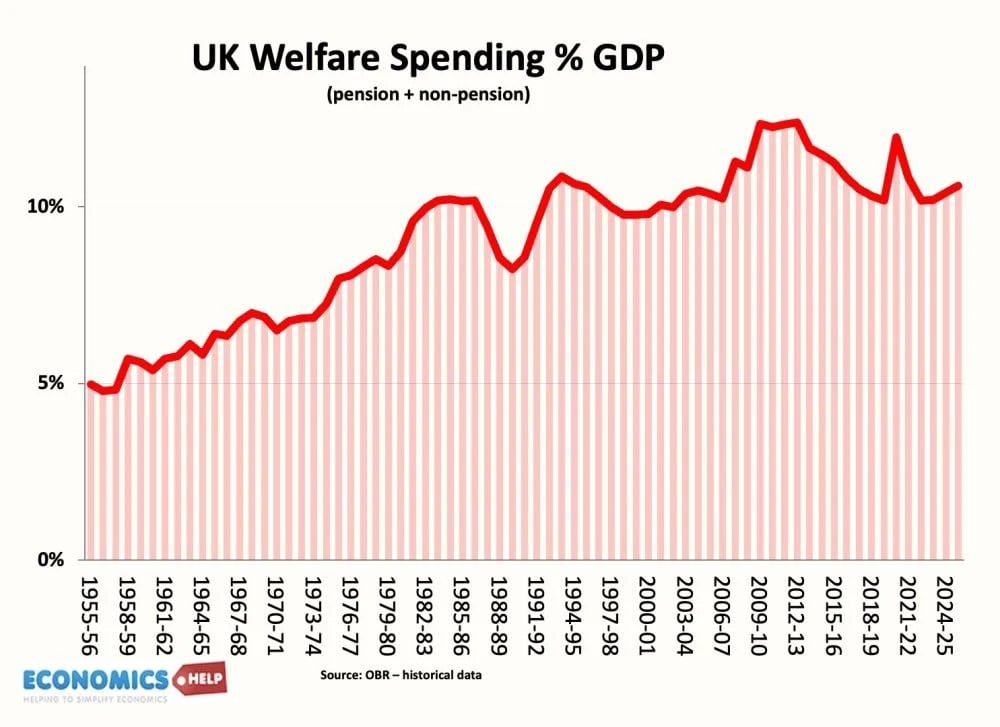

This may surprise you but overall welfare spending as a percentage of GDP has come down, mainly due to the austerity imposed since the coalition government, it's just there are a lot more people claiming sickness and disability benefits than there were five years ago. This is understandably a problem if it keeps increasing.

One of the biggest increases in government spending has actually been debt repayment.1 -

My question was only a scenario of how the rules affect different circumstances. 2 people same amount of savings, 1 gets, say £500 a month of rent paid or £6000 a year and the other claims no rent. Surely an amount of extra savings would be fair. And before anyone says I'm lucky to own a mortgage free home, I have lived here 34 years, bought it derelict and renovated it whilst living in with 2 young children.

And in which world would a bank lend so much money to someone on benefits?

1 -

You have hit the nail on the head it is "there are a lot more people claiming sickness and disability benefits than there were five years ago." Nobody has an issue over 2020 levels of benefits, it is the colossal increases since. Quoted increases of 66% and rising.

I think we have expressed our opinions amicably, I don't think more can be said. Thanks you.

2 -

Well done. It may come as a surprise too but I am also a home owner. I think it's fair that mortgage companies treat different types of income differently but to flatly refuse to lend at all simply because the person is on benefits is wrong. It's discrimination and helps entrench poverty, it's almost as bad 'No DSS' notices on rentals.

The decision to lend should be based on the person's credit history not the fact they're claiming benefits and out of work because they're sick3 -

Agreed. But that would require the Establishment to accept committing democide against disabled people is a bad thing, so they won't do this for a while.

The "public outcry" towards benefits claimants is horseshit based on internalised ableism combined with misinformation. Their views need correcting via mass education in the media, if not discarded entirely, alongside politicians adocatng hate/eugenics getting thrown in prison for manty yaears.

2 -

Unlike a lot of views about politics horseshit is useful

2 -

Did someone just mention eugenics? How does such disproportionate hysteria help anyone's cause?

1 -

Trevor, your comment that the Personal Tax Allowance could be why some people “choose not to work” doesn’t reflect the reality for many in this community.

For a lot of our members, it isn’t a matter of choice. They are unable to work due to illness or disability. That’s the reality.

I am disabled too, and I work. I’ve paid the highest rate of tax for years, and I certainly wouldn’t walk away from my job just because of the Personal Tax Allowance.

I don’t see how that point is relevant to the discussion about raising the DWP capital limits. Changing the savings rules would not affect taxpayers in any meaningful way. They have far bigger concerns than whether disabled people can hold on to a modest nest egg.

Increasing the capital limit would simply allow more taxpayers today to access support if they become sick or disabled in the future, through no fault of their own. I honestly don’t understand the objection to this.

4 -

I am not referring to members of this community when I say I genuinely think the pathetic Personal Tax Free Allowance stops people looking for work. It does because I hear comments like *your wages are eaten away by tax anyway" or "it's not worth It because of all the tax you pay." It has been frozen for more than 10 years which is disgraceful and enough is enough quite honestly. Government petition this year refused to increase it to a modest £20,000. I have given you actual examples of people avoiding work and I am telling you why they are. Two years to get a replacement at that car rental station after all those interviews and no takers who are just going though the UC process to remain on UC. A family member had to fill the role or they would have been short staffed and overworked for longer!!

It would affect taxpayers though and I think they have had enough quite honestly, strength of feeling is at a high presently. I doubt the Accounts Clerk Reeves would even move on this one currently. She is nearly out of a job herself.

Point taken on the last paragraph, but a lot of workers work/budget week by week. My mate has two jobs but no money in the bank, plenty on credit cards though......

That is my opinion based on working and you are entitled to yours, thank you.

1

Categories

- All Categories

- 15.8K Start here and say hello!

- 7.5K Coffee lounge

- 105 Games den

- 1.8K People power

- 159 Announcements and information

- 25.2K Talk about life

- 6.2K Everyday life

- 508 Current affairs

- 2.5K Families and carers

- 873 Education and skills

- 2K Work

- 579 Money and bills

- 3.7K Housing and independent living

- 1.1K Transport and travel

- 642 Relationships

- 1.6K Mental health and wellbeing

- 2.5K Talk about your impairment

- 879 Rare, invisible, & undiagnosed conditions

- 939 Neurological impairments and pain

- 2.2K Cerebral Palsy Network

- 1.2K Autism and neurodiversity

- 40.8K Talk about your benefits

- 6.1K Employment & Support Allowance (ESA)

- 20.3K PIP, DLA, ADP & AA

- 9.1K Universal Credit (UC)

- 5.3K Benefits and income