Inheritance

celt34

Online Community Member Posts: 2 Listener

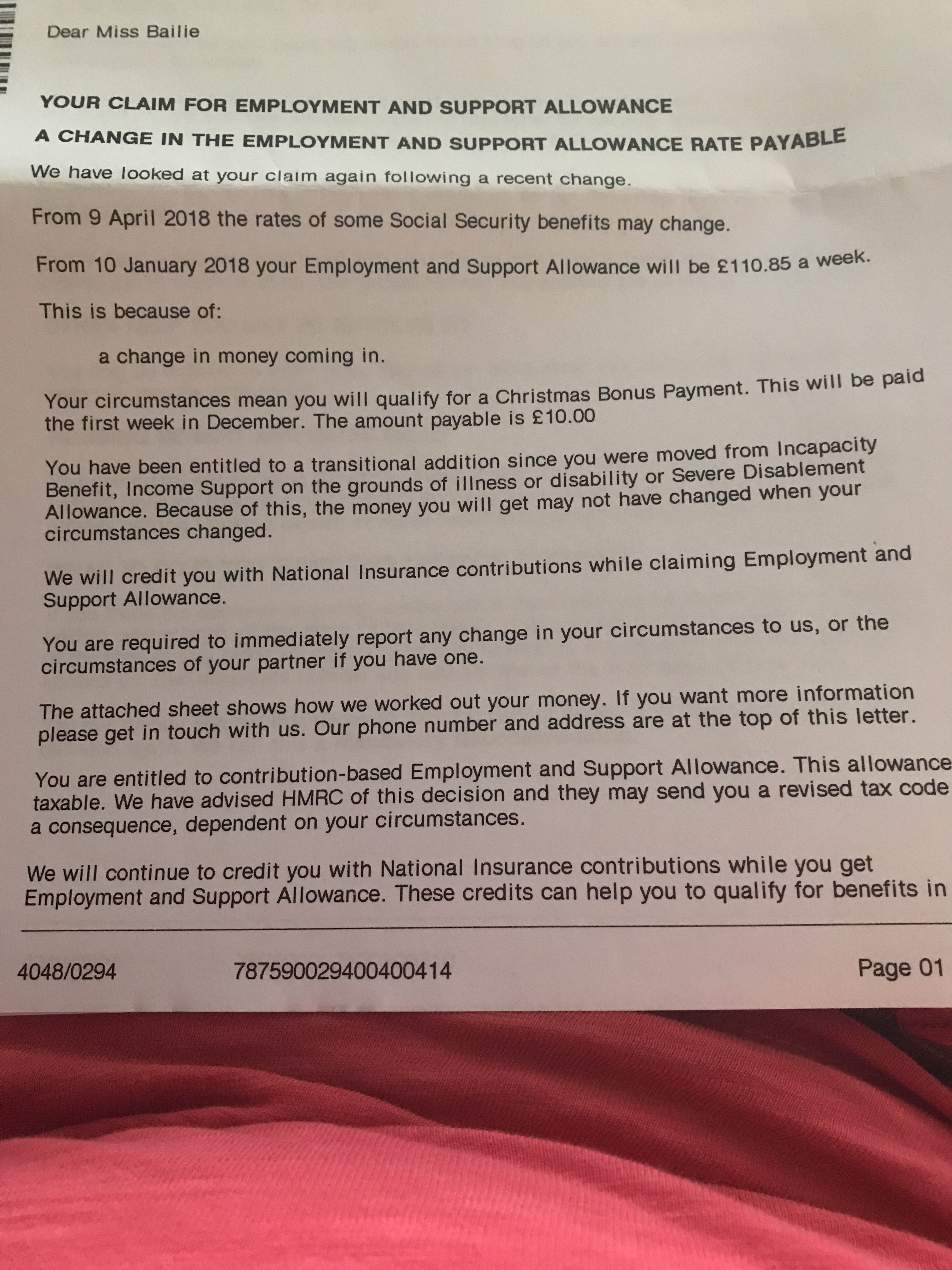

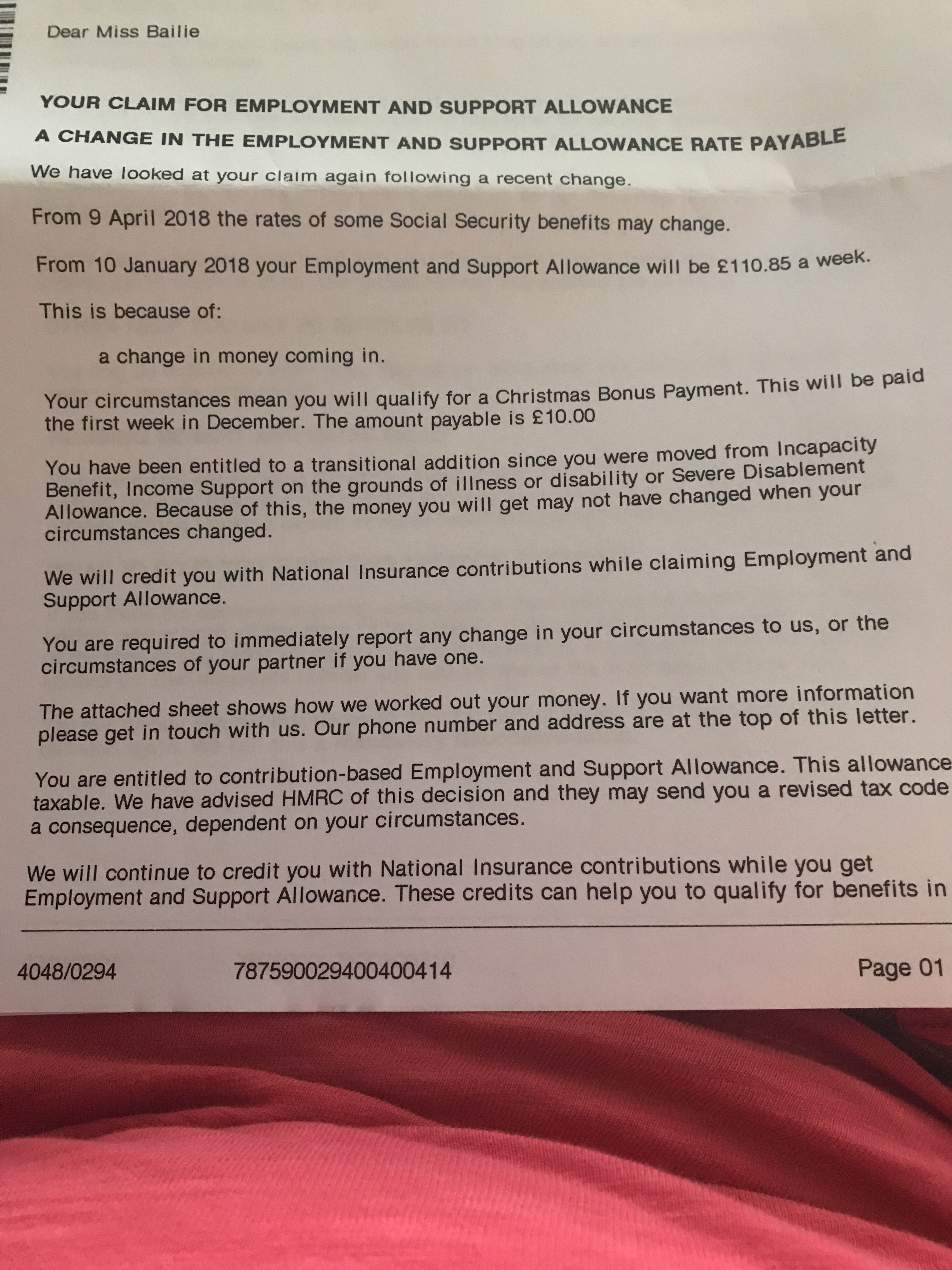

hi folks, I’ve been on ESA for many years. My dad passed at beginning of year and I’m just about to receive inheritance money. I’ve been told over £16,000 my ESA will stop and I have to tell them everything I spend. Then today someone asked me what kind of ESA I’m on, I dug out a letter which says contribution based so they said inheritance money won’t affect it. I’m so confused and have attached the letter to see if anyone can clarify for me, sorry for long post.

0

Comments

-

Hi,Yes you're claiming Contributions based ESA and savings/capital aren't affected by this. However, if you claiming housing benefit or council tax reduction then these will be affected by savings/capital and the same rules apply, any savings over £16,000 and your housing benefit and council tax reduction will stop. You need to report any changes to your local council.0

-

Unless of course your ESA money has changed since April and you now claim extra money for the Income related top up. I see that letter is changes up until 10th April 2018.

0 -

Thank you, I just found a more recent letter and it says the same so I’ll phone next week as I’m still supposed to inform them ?0

Categories

- All Categories

- 15.7K Start here and say hello!

- 7.5K Coffee lounge

- 105 Games den

- 1.7K People power

- 156 Announcements and information

- 25.1K Talk about life

- 6.2K Everyday life

- 505 Current affairs

- 2.5K Families and carers

- 895 Education and skills

- 2K Work

- 574 Money and bills

- 3.7K Housing and independent living

- 1.1K Transport and travel

- 641 Relationships

- 1.6K Mental health and wellbeing

- 2.5K Talk about your impairment

- 878 Rare, invisible, and undiagnosed conditions

- 936 Neurological impairments and pain

- 2.2K Cerebral Palsy Network

- 1.2K Autism and neurodiversity

- 40.5K Talk about your benefits

- 6.1K Employment and Support Allowance (ESA)

- 20.2K PIP, DLA, ADP and AA

- 9K Universal Credit (UC)

- 5.3K Benefits and income